Introduction to Private Limited Companies

Private limited companies are one of the most popular ways to run a business in the UK. They're called "private" because their shares aren't sold to the general public on the stock exchange. Instead, shares are owned by a small group of people - often family members, friends, or business partners. You'll recognise these companies by "Ltd" after their name.

Think of companies like John Lewis Partnership, Dyson, or your local family-run restaurant that's grown into a small chain. These are all examples of private limited companies that started small but kept control within a close group of owners.

Key Definitions:

- Private Limited Company: A business owned by shareholders whose liability is limited to their investment, with shares not traded publicly.

- Shareholders: People who own shares (parts) of the company and have a say in how it's run.

- Limited Liability: Owners can only lose the money they invested - their personal belongings are protected.

- Articles of Association: The rules that govern how the company operates internally.

🏢 Company Structure

A private limited company has a clear structure with shareholders who own it, directors who run it day-to-day and employees who work for it. The company exists as its own legal entity - separate from the people who own and run it.

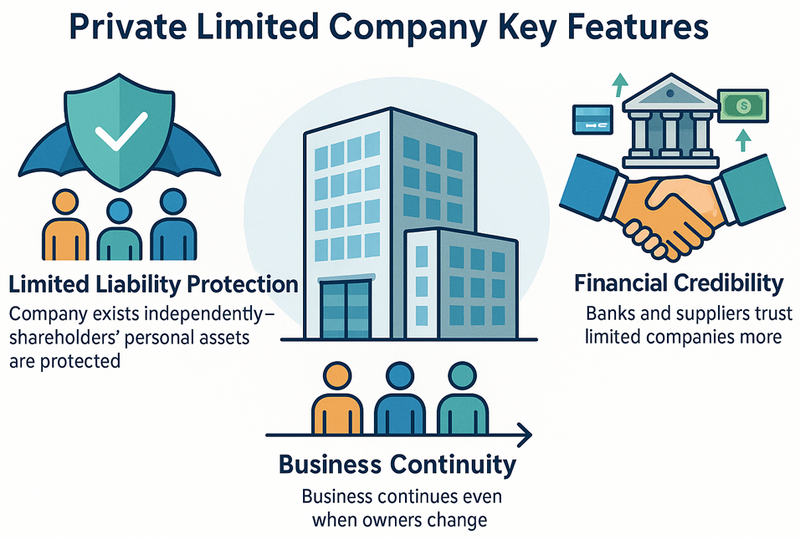

Key Features of Private Limited Companies

Private limited companies have several distinctive features that set them apart from sole traders, partnerships and public limited companies. Understanding these features helps explain why many entrepreneurs choose this business structure.

Legal Identity and Limited Liability

The most important feature is that a private limited company is a separate legal entity. This means the company can own property, make contracts and be sued in its own name - not in the names of its owners. This separation creates limited liability protection for shareholders.

🛡 Legal Protection

If the company gets into debt or faces legal problems, shareholders can only lose what they invested. Their homes, cars and personal savings are protected.

💳 Financial Security

Banks and suppliers often prefer dealing with limited companies because they seem more professional and permanent than sole traders.

💼 Business Continuity

The company continues to exist even if shareholders leave or die, making it easier to plan for the future.

Case Study Focus: Innocent Drinks

Innocent Drinks started as a private limited company in 1999 when three Cambridge graduates sold smoothies at a music festival. They asked customers to vote by throwing empty bottles into "YES" or "NO" bins about whether they should quit their jobs to make smoothies. The "YES" bin won and they formed Innocent Ltd. The company grew rapidly while remaining private, eventually selling to Coca-Cola in 2013 for over £300 million. The limited liability structure protected the founders' personal assets during the risky early years.

Advantages of Private Limited Companies

There are many reasons why entrepreneurs choose to form private limited companies rather than operating as sole traders or partnerships.

Financial and Legal Benefits

The financial advantages often make the extra paperwork worthwhile for growing businesses.

💰 Tax Efficiency

Corporation tax rates are often lower than personal income tax rates. Directors can also take money out as dividends, which may be taxed more favourably than salaries.

📈 Easier Growth

Companies can raise money by selling shares to new investors without losing control, as shares don't have to be sold publicly.

🏠 Professional Image

Having "Ltd" after the name makes businesses appear more established and trustworthy to customers and suppliers.

🔒 Ownership Control

Existing shareholders control who can buy shares, keeping ownership within the desired group of people.

Disadvantages and Challenges

While private limited companies offer many benefits, they also come with responsibilities and costs that don't apply to simpler business structures.

Regulatory Requirements

Companies must follow strict rules about record-keeping, reporting and decision-making that can be time-consuming and expensive.

📝 Paperwork Burden

Annual accounts, confirmation statements and other documents must be filed with Companies House every year, often requiring professional help.

👁 Public Information

Company details, including director names and financial information, are publicly available online for anyone to see.

💲 Setup and Running Costs

Formation costs, accountancy fees and Companies House filing fees make limited companies more expensive to run than sole trader businesses.

Real Example: Local Success Story

Sarah's Bakery started as a sole trader business in 2018. When Sarah wanted to open a second shop in 2020, she converted to Sarah's Bakery Ltd. This allowed her business partner Emma to invest £20,000 for a 40% share without Sarah having to give up control. The limited liability protection was crucial when they signed a large commercial lease. By 2023, they had four shops and were considering franchising - something much easier to do as a limited company.

Setting Up a Private Limited Company

The process of forming a private limited company involves several steps and legal requirements. While it's more complex than starting as a sole trader, it's still relatively straightforward.

The Formation Process

You can set up a company online through Companies House for £12, or use a formation agent for around £100-£300 if you want professional help.

📄 Required Documents

You'll need a Memorandum of Association (basic company details) and Articles of Association (rules for running the company). Most people use standard templates provided by Companies House.

Essential Requirements:

- Company Name: Must be unique and end with "Limited" or "Ltd"

- Registered Office: A UK address where official mail will be sent

- Directors: At least one director who is a real person (not another company)

- Shareholders: At least one person who owns shares in the company

- Share Capital: The total value of shares issued (can be as little as £1)

Running a Private Limited Company

Once formed, private limited companies must follow ongoing legal requirements and maintain proper records.

Director Responsibilities

Company directors have legal duties that they must take seriously. Breaking these rules can lead to personal liability and even criminal charges.

⚖ Fiduciary Duties

Directors must act in the company's best interests, not their own personal interests and avoid conflicts of interest.

📊 Record Keeping

Maintain accurate accounting records, hold annual general meetings and file annual accounts and confirmation statements.

⚖ Legal Compliance

Follow employment law, health and safety regulations and ensure the company can pay its debts when due.

Case Study: Growth Through Investment

TechStart Ltd was founded by two university friends with £1,000 each in 2019. Their app development company struggled initially, but the limited liability structure meant they could take risks without endangering their personal finances. In 2021, they attracted a £50,000 investment from a local business angel in exchange for 25% of the shares. This investment allowed them to hire three developers and win major contracts. By 2024, the company employed 15 people and was valued at over £2 million. The flexible share structure of a private limited company made this growth possible while keeping the founders in control.

Comparison with Other Business Types

Understanding how private limited companies compare to other business structures helps explain when this option makes most sense.

When to Choose Private Limited Status

Private limited companies work best for businesses that need investment, have multiple owners, or face significant risks.

💡 Best For

Growing businesses, partnerships wanting limited liability, companies needing external investment and businesses with valuable assets or high-risk activities.

Unlike sole traders, private limited companies offer liability protection but require more administration. Unlike public limited companies, they can't sell shares to the general public but have fewer regulatory requirements. Unlike partnerships, they provide limited liability but are more complex to set up and run.

Future Considerations

Many private limited companies eventually consider their next steps as they grow and develop.

Growth Options

Successful private limited companies might eventually become public limited companies to raise capital from the stock market, or they might be acquired by larger businesses. Some remain private limited companies throughout their existence, which is perfectly valid for businesses that don't need public investment.

🎯 Success Factors

The most successful private limited companies focus on building strong management teams, maintaining good relationships with shareholders and ensuring compliance with all legal requirements while growing their business.