Introduction to Public Limited Companies

A Public Limited Company (PLC) is a type of business organisation that can sell its shares to the general public through stock exchanges like the London Stock Exchange. Think of companies like Tesco, British Airways, or Marks & Spencer - these are all PLCs that you probably know well!

PLCs are the "big players" in the business world. They're often large companies with thousands of employees and millions of pounds in revenue. But what makes them special is that anyone can buy a piece of the company by purchasing shares.

Key Definitions:

- Public Limited Company (PLC): A company that can sell shares to the public and is listed on a stock exchange.

- Shares: Units of ownership in a company that can be bought and sold.

- Shareholders: People or organisations who own shares in a company.

- Stock Exchange: A marketplace where shares are bought and sold.

- Flotation: The process of a company becoming public and listing on a stock exchange.

🏦 From Private to Public

Many PLCs start as private companies and then "go public" when they need more money to grow. This process is called flotation. For example, Facebook started as a private company but became a PLC in 2012 to raise billions for expansion.

How PLCs Work

PLCs operate differently from private companies because they have to answer to many shareholders instead of just a few owners. When you buy shares in a PLC, you become a part-owner of that business, even if you only own a tiny fraction!

Share Ownership and Control

In a PLC, ownership is divided into millions of shares. Each share represents a small piece of the company. The more shares you own, the bigger your say in how the company is run. Shareholders get to vote on important decisions at Annual General Meetings (AGMs).

💰 Raising Capital

PLCs can raise huge amounts of money by selling shares to thousands of investors. This money can fund expansion, research, or new products.

📈 Share Prices

Share prices go up and down based on how well the company is doing and what investors think about its future prospects.

📊 Dividends

When PLCs make profits, they often pay dividends - a share of the profits - to their shareholders as a reward for investing.

Case Study Focus: Tesco PLC

Tesco is one of the UK's largest PLCs. It has over 300,000 employees and operates in multiple countries. Anyone can buy Tesco shares on the London Stock Exchange. The company pays dividends to shareholders and must publish detailed financial reports every year. When Tesco performs well, its share price rises, benefiting all shareholders.

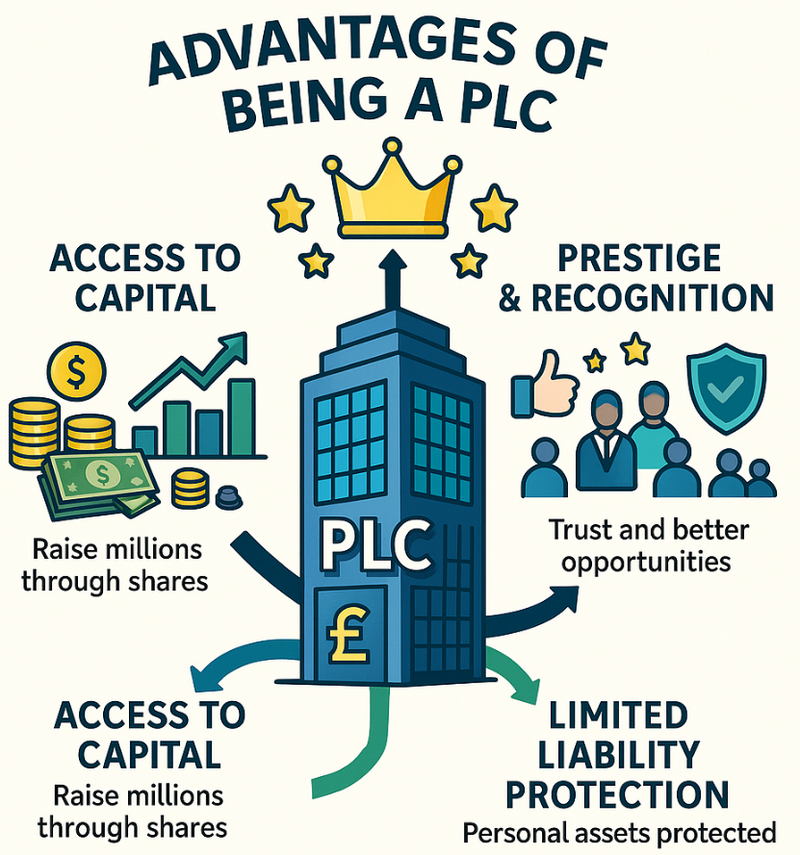

Advantages of Being a PLC

There are several major benefits that come with being a public limited company, which is why many successful businesses choose this route.

Access to Capital

The biggest advantage is the ability to raise enormous amounts of money. When a company goes public, it can sell millions of shares and raise billions of pounds. This money can be used for:

- Expanding into new markets or countries

- Investing in research and development

- Buying other companies

- Upgrading technology and equipment

🎯 Prestige and Recognition

Being a PLC gives a company prestige and credibility. Customers, suppliers and partners often trust PLCs more because they're regulated and transparent. This can lead to better business deals and opportunities.

Limited Liability Protection

Like private limited companies, PLCs offer limited liability protection. This means shareholders can only lose the money they invested in shares - they're not personally responsible for the company's debts.

Disadvantages of Being a PLC

However, being a PLC isn't all positive. There are significant challenges and drawbacks that companies must consider.

Loss of Control

When a company goes public, the original owners lose some control. Shareholders can vote on major decisions and if they're unhappy, they might even vote to remove the management team. This can make it harder for founders to run the company as they wish.

📖 Regulatory Requirements

PLCs must follow strict rules and publish detailed financial reports regularly. This costs time and money.

👁 Public Scrutiny

Everything a PLC does is public knowledge. The media and competitors can see their financial performance and business strategies.

💰 Expensive Process

Going public costs millions in legal fees, accounting costs and stock exchange listing fees.

Short-term Pressure

PLCs face constant pressure to show good results every three months (quarterly reports). This can force them to focus on short-term profits rather than long-term growth, which might not always be best for the business.

Case Study Focus: John Lewis Partnership

Interestingly, John Lewis chose NOT to become a PLC. Instead, it remains owned by its employees (called Partners). The company believes this allows them to focus on long-term customer service rather than short-term profits for shareholders. This shows that being a PLC isn't right for every business.

Legal Requirements for PLCs

PLCs must meet strict legal requirements that don't apply to private companies. These rules exist to protect investors and ensure transparency.

Minimum Requirements

To become a PLC, a company must have:

- At least £50,000 in share capital

- At least two shareholders

- At least two directors

- A qualified company secretary

- "PLC" or "Public Limited Company" in its name

Ongoing Obligations

Once established, PLCs must:

- Hold Annual General Meetings (AGMs) for shareholders

- Publish annual reports and accounts

- File quarterly financial reports

- Follow stock exchange listing rules

- Comply with corporate governance codes

Famous UK PLCs

Many companies you interact with daily are PLCs. Here are some examples that demonstrate the variety of industries where PLCs operate:

🍽 Retail PLCs

Tesco, Sainsbury's, Marks & Spencer: These supermarket and retail chains are all PLCs, allowing millions of customers to also be shareholders in the businesses they shop at.

✈ Transport PLCs

British Airways, easyJet: Major airlines that use PLC status to raise money for expensive aircraft and route expansion.

Technology and Media PLCs

Companies like BT Group (telecommunications) and ITV (television) show how PLCs operate in modern digital industries. These companies need massive investments in technology infrastructure, which PLC status helps them fund.

The Future of PLCs

PLCs continue to be vital to the UK economy, providing jobs for millions and generating tax revenue for the government. However, they face new challenges from changing technology, environmental concerns and evolving customer expectations.

Modern PLCs are increasingly focused on:

- Environmental sustainability and social responsibility

- Digital transformation and online services

- Transparent communication with shareholders and stakeholders

- Balancing profit with purpose

Did You Know?

The London Stock Exchange is over 300 years old and lists hundreds of PLCs. The total value of all companies listed on the LSE is worth trillions of pounds, making it one of the world's most important financial centres.