⚠ Why Does This Matter?

Choosing the wrong business structure can mean losing your house, car and savings if things go wrong. It's one of the most important decisions any business owner makes!

Sign up to access the complete lesson and track your progress!

Unlock This Course

When starting a business, entrepreneurs must decide on the type of organisation they want to create. This choice affects everything from how much personal risk they face to how they can raise money and make decisions. Understanding these different types helps us see why businesses operate the way they do.

Key Definitions:

Choosing the wrong business structure can mean losing your house, car and savings if things go wrong. It's one of the most important decisions any business owner makes!

There are several main types of business ownership, each with different levels of risk, control and legal protection. Let's explore each one and see how they work in practice.

A sole trader is the simplest form of business ownership where one person owns and runs the entire business. They keep all the profits but also face all the risks.

Easy to set up, complete control over decisions, keep all profits, flexible working hours, simple tax arrangements.

Unlimited liability, limited capital, long working hours, difficulty taking holidays, business dies with owner.

Local plumbers, hairdressers, freelance photographers, market stall traders, tutors.

Sarah runs a small bakery as a sole trader. She loves the freedom to create her own recipes and keep all profits. However, when a customer claimed food poisoning and sued for £50,000, Sarah faced unlimited liability. This meant she could have lost her home to pay the legal costs, highlighting the major risk sole traders face.

A partnership involves two or more people sharing ownership of a business. They share profits, losses and decision-making responsibilities according to their partnership agreement.

Shared workload and expertise, more capital available, shared decision-making, different skills combined.

Unlimited liability, shared profits, potential disagreements, joint responsibility for partner's actions.

Law firms, medical practices, accounting firms, small restaurants, consultancy businesses.

Limited companies are separate legal entities from their owners. This means the company can own assets, make contracts and be sued independently of its owners (shareholders).

These are small to medium-sized companies where shares cannot be sold to the general public. Ownership is restricted to specific individuals, often family members or close associates.

Limited liability protection, separate legal identity, shares cannot be publicly traded, minimum one director required, must file annual accounts.

Large companies that can sell shares to the public through stock exchanges. They have strict legal requirements but can raise significant amounts of capital.

Limited liability, large amounts of capital, shares easily transferred, professional management, economies of scale.

Complex legal requirements, expensive to set up, loss of control, public scrutiny, profit pressure from shareholders.

Tesco, British Airways, Vodafone, Rolls-Royce, BP, HSBC.

James Dyson started his company as a private limited company in 1991. The limited liability structure protected his personal assets while he developed his revolutionary vacuum cleaner. This allowed him to take risks with innovation without risking his family home. Today, Dyson remains a private limited company, showing that not all successful businesses need to become PLCs.

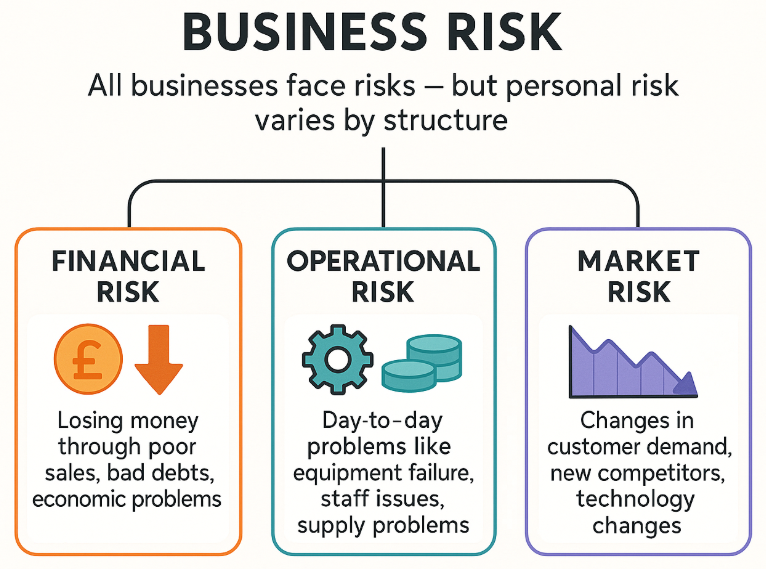

All businesses face risks, but the level of personal risk to owners varies dramatically depending on the business structure chosen.

Business risk comes in many forms and understanding these helps explain why limited liability is so important for larger businesses.

Risk of losing money through poor sales, bad debts, economic downturns, or unexpected costs like legal claims.

Risk from day-to-day operations like equipment failure, staff problems, supply chain issues, or quality problems.

Risk from changes in customer demand, new competitors, technological changes, or shifts in consumer preferences.

The choice of business structure significantly affects how owners deal with risk, raise money and make decisions.

Unlimited liability means if your business owes £100,000 but only has £10,000 in assets, you personally owe the remaining £90,000. Limited liability means you only lose what you invested - your personal assets are protected.

Different business structures have varying abilities to raise money for growth and expansion.

Limited to personal savings, bank loans and retained profits. Growth is often slow due to capital constraints.

Can pool partners' resources and may find it easier to get loans due to shared responsibility.

Can sell shares to raise capital. PLCs can access stock markets for significant funding.

Ben and Jerry started their ice cream business as a partnership but found they couldn't raise enough money to compete with larger companies. They eventually became a limited company and later sold shares to the public, raising millions for expansion. However, this meant giving up some control to shareholders - a common trade-off in business growth.

Choosing the right business structure depends on several factors including the level of risk, amount of capital needed and desired level of control.

Entrepreneurs must weigh various factors when choosing their business structure, as each has different implications for their personal and financial situation.

How much personal risk can I afford? Do I need to raise large amounts of money? Am I willing to share control? How complex are the legal requirements I can handle?

Understanding these different types of business ownership and their relationship to risk and liability is crucial for anyone considering starting a business or working in the business world. The choice affects everything from personal financial security to growth potential and operational flexibility.