🏢 Types of Business Organisations

Businesses come in different shapes and sizes, from sole traders working alone to massive public companies with thousands of shareholders. Each type has different ways of raising money and using profits.

Sign up to access the complete lesson and track your progress!

Unlock This Course

Every business needs money to start up, grow and operate day-to-day. Whether you're opening a corner shop or launching the next big tech company, understanding where money comes from and how it's used is crucial for success. Different types of businesses have access to different sources of finance and how they use their profits can determine their future growth.

Key Definitions:

Businesses come in different shapes and sizes, from sole traders working alone to massive public companies with thousands of shareholders. Each type has different ways of raising money and using profits.

Understanding the different types of business organisations helps us see why they need different sources of finance and use profits in various ways.

A sole trader is someone who runs their own business. They're the boss, make all decisions and keep all profits. However, they're also responsible for all debts and losses. Think of your local plumber, hairdresser, or corner shop owner.

Easy to set up, complete control, keep all profits, make quick decisions

Unlimited liability, limited finance options, work long hours, business dies with owner

Personal savings, bank loans, family loans, government grants

When two or more people join together to run a business, they form a partnership. Partners share profits, losses and decision-making. Law firms, dental practices and accounting firms often operate as partnerships.

Shared workload, more capital available, shared expertise, shared decision-making

Unlimited liability, shared profits, potential disagreements, joint responsibility for debts

Partners' savings, bank loans, retained profits, new partner investment

These companies are owned by shareholders but shares cannot be sold to the general public. Many family businesses and small to medium enterprises choose this structure. Examples include many local restaurants, small tech companies and family-run manufacturers.

Limited liability, separate legal identity, can raise capital through shares, continuity

More paperwork, public disclosure of accounts, corporation tax, cannot sell shares publicly

Share capital, retained profits, bank loans, debentures, venture capital

These are large companies that can sell shares to the general public on the stock exchange. Think of companies like Tesco, British Airways, or Rolls-Royce. They have many shareholders and are run by professional managers.

Raise large amounts of capital, limited liability, professional management, economies of scale

Complex regulations, public scrutiny, risk of takeover, divorce of ownership and control

Share issues, retained profits, debentures, bank loans, government grants

Greggs started as a small bakery in Newcastle in 1939. It grew from a family business to a partnership, then became a private limited company and finally went public in 1984. Today, it's one of the UK's largest bakery chains with over 2,000 shops. This shows how businesses can evolve and access different sources of finance as they grow.

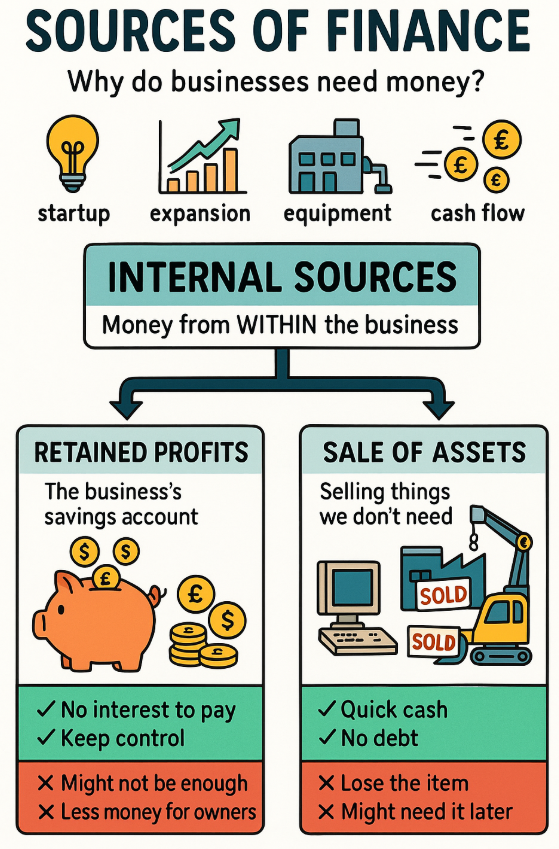

Businesses need money for different reasons - starting up, expanding, buying equipment, or managing cash flow problems. The source of finance they choose depends on how much they need, how long they need it for and what type of business they are.

These come from within the business itself. They're often the cheapest option because you don't pay interest to outsiders.

Money the business has earned but not paid out to owners. It's like the business's savings account. Advantages: No interest, no loss of control. Disadvantages: May not be enough, reduces dividends to shareholders.

Selling things the business owns but doesn't need. For example, selling old equipment or unused buildings. Advantages: Quick cash, no debt. Disadvantages: Lose the asset, may need it later.

These come from outside the business. There are many options, each with different advantages and disadvantages.

Allows you to spend more than you have in your account. Good for: Cash flow problems, unexpected expenses. Drawback: High interest rates.

Buying goods now but paying later (usually 30-90 days). Good for: Managing cash flow, building supplier relationships. Drawback: May miss early payment discounts.

Selling your unpaid invoices to a factoring company for immediate cash. Good for: Immediate cash, no bad debts. Drawback: Expensive, lose customer contact.

Borrowing a fixed amount for a set period. Good for: Buying equipment, expansion. Advantages: Keep control, fixed payments. Disadvantages: Interest payments, security required.

Selling parts of the business to investors. Good for: Large amounts, no repayment required. Advantages: No interest, share expertise. Disadvantages: Lose control, share profits.

Long-term loans with fixed interest rates. Good for: Large companies, major investments. Advantages: Fixed interest, long-term. Disadvantages: Must pay interest, security required.

In 1999, three friends started Innocent Drinks with £500 from selling smoothies at a music festival. They used personal savings initially, then got a £250,000 bank loan. As they grew, they sold shares to angel investors, then later to Coca-Cola. This shows how businesses often use multiple sources of finance as they develop.

When a business makes a profit, owners must decide what to do with it. This decision affects the business's future growth and the rewards for owners.

Keeping profits in the business for future use. This is like the business saving money for a rainy day or future opportunities.

Funds for expansion, no interest payments, maintains control, builds reserves for difficult times, shows financial strength to lenders.

Paying profits out to the business owners. The method depends on the type of business organisation.

Keep all profits as personal income. They can withdraw money whenever they want since they own the entire business.

Share profits according to partnership agreement. Usually based on capital invested or work contributed.

Pay dividends to shareholders. Directors decide how much to pay, balancing shareholder rewards with business needs.

Using profits to expand the business. This could mean opening new locations, buying better equipment, or developing new products.

Research and development, new equipment, staff training, marketing campaigns, new premises, technology upgrades. These investments can lead to higher future profits.

For many years, Amazon made little profit because it reinvested everything back into the business. While shareholders received no dividends, the company grew rapidly and became one of the world's most valuable companies. This shows how retaining profits can create long-term value, even if it means short-term sacrifice.

Selecting the best source of finance depends on several factors. Smart business owners consider all options before making decisions.

Small amounts: Personal savings, overdraft. Large amounts: Loans, share capital, debentures.

Short-term: Overdraft, trade credit. Long-term: Loans, share capital, retained profits.

Cheapest: Retained profits, trade credit. Most expensive: Overdrafts, factoring. Consider interest rates and fees.

Business owners must balance keeping control with accessing finance for growth. Selling shares brings money but reduces control. Loans maintain control but create debt obligations.